Learn about Puerto Rico Sales Tax Financing Corporation (COFINA) including our News & Press Releases and Management Team.

Talk to us

Have questions? Reach out to us directly.

Learn about Puerto Rico Sales Tax Financing Corporation (COFINA) including our News & Press Releases and Management Team.

About Puerto Rico Sales Tax Financing Corporation (COFINA)

- Founded

- 12/26/2006

The Puerto Rico Sales Tax Financing Corporation (by its Spanish acronym, “COFINA”) is a public corporation of the Commonwealth of Puerto Rico, created under Act No. 91 of May 13, 2006, as amended. COFINA is legally independent and separate from the Commonwealth and any other government entity, with its business and affairs governed by its Board of Directors.

Originally established to finance certain appropriation-backed debt and other Commonwealth expenses, COFINA became central to Puerto Rico’s fiscal restructuring process. On November 15, 2018, Act 241-2018 was enacted to amend and restate Act 91-2006, establishing the legal framework for the restructuring of COFINA’s outstanding bonds. Among other things, Act 241-2018 (i) modified the Corporation’s governance structure, (ii) authorized the issuance of the restructured COFINA Bonds, (iii) confirmed the Corporation’s ownership of the COFINA Revenues, (iv) created a statutory lien securing those bonds, and (v) enacted covenants to further protect repayment.

In February 2019, COFINA successfully restructured approximately $17.6 billion of legacy debt through a Title III proceeding under PROMESA, issuing roughly $12 billion of new COFINA Bonds. This restructuring resolved long-standing disputes over sales and use tax revenues between COFINA and the Commonwealth, providing certainty and stability for bondholders and the Government of Puerto Rico.

Governance Improvements

Since its restructuring, COFINA has operated under a robust governance and oversight framework. The 2019 Master Trust Indenture established strong covenants and protections for bondholders, including a statutory lien on pledged sales tax revenues, clear waterfall priorities, and separation from the Commonwealth’s general resources. The Board of Directors, supported by management, external advisors and annual independent audits, ensures transparency, accountability, and compliance with all fiscal and legal requirements.

Recent Accomplishments

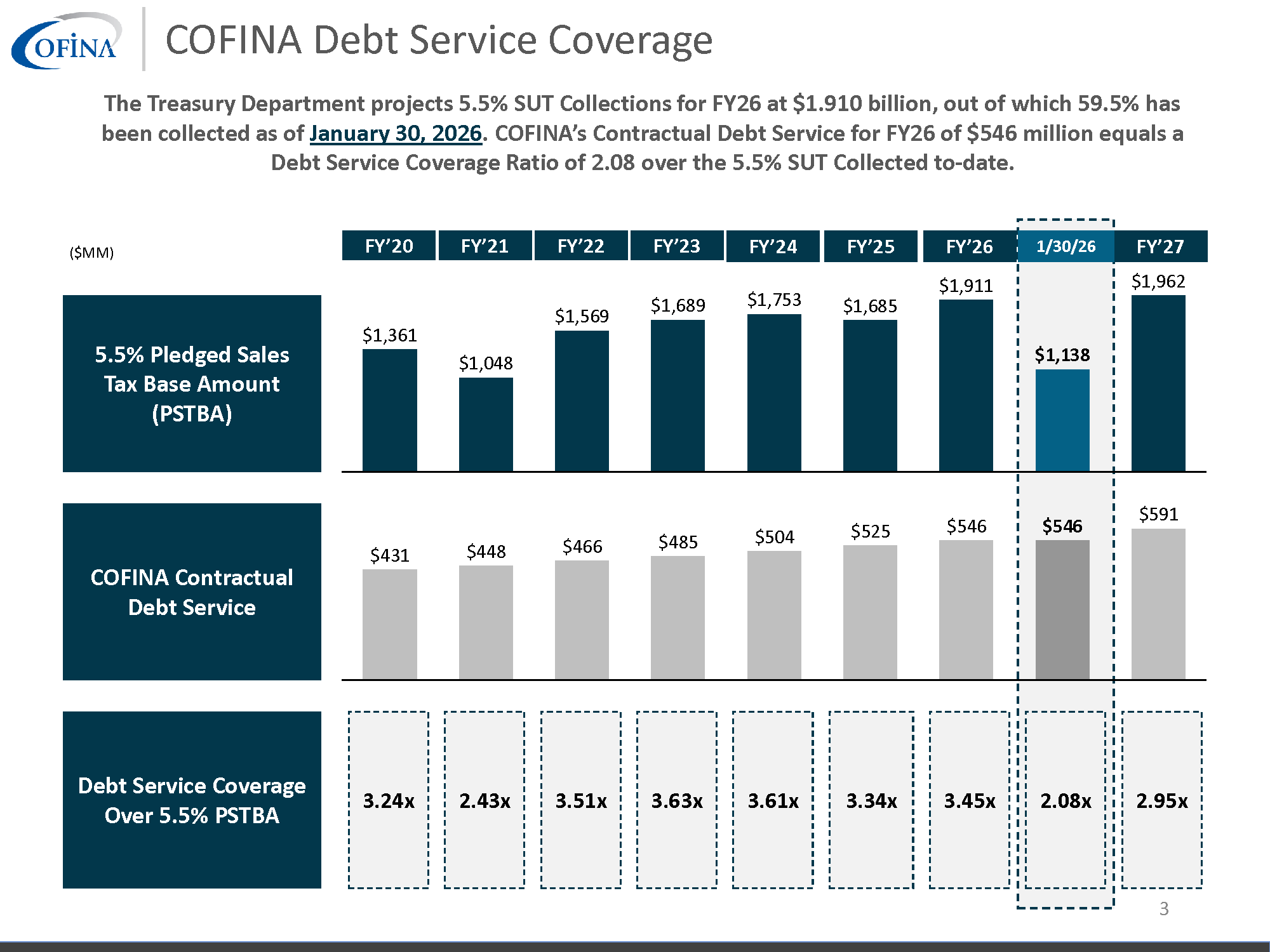

- Revenue Performance: COFINA has consistently met its pledged revenue targets ahead of schedule. In FY2025, the Corporation reached its statutory $531.7 million revenue target by October 21, 2024—only 112 days into the fiscal year.

- Financial Strength: Debt service coverage ratios have remained robust, averaging well above 2.5x in recent fiscal years.

- Operational Stability: The Operating Reserve Fund has been fully funded, exceeding $15 million, and COFINA continues to operate with strong liquidity.

- Transparency & Reporting: COFINA publishes audited financial statements, annual reports, and continuing disclosure filings in compliance with SEC and MSRB standards.

Ongoing Initiatives

- Fiscal Plan Alignment: COFINA works closely with the Puerto Rico Fiscal Agency and Financial Advisory Authority (AAFAF) and the Financial Oversight and Management Board (FOMB) to ensure compliance with certified Fiscal Plans and budgets.

- Commitment to Puerto Rico: By securing bondholder confidence and ensuring predictable transfers of excess sales tax revenues to the Commonwealth’s General Fund, COFINA contributes directly to Puerto Rico’s fiscal recovery and long-term economic stability.

Image Gallery

News

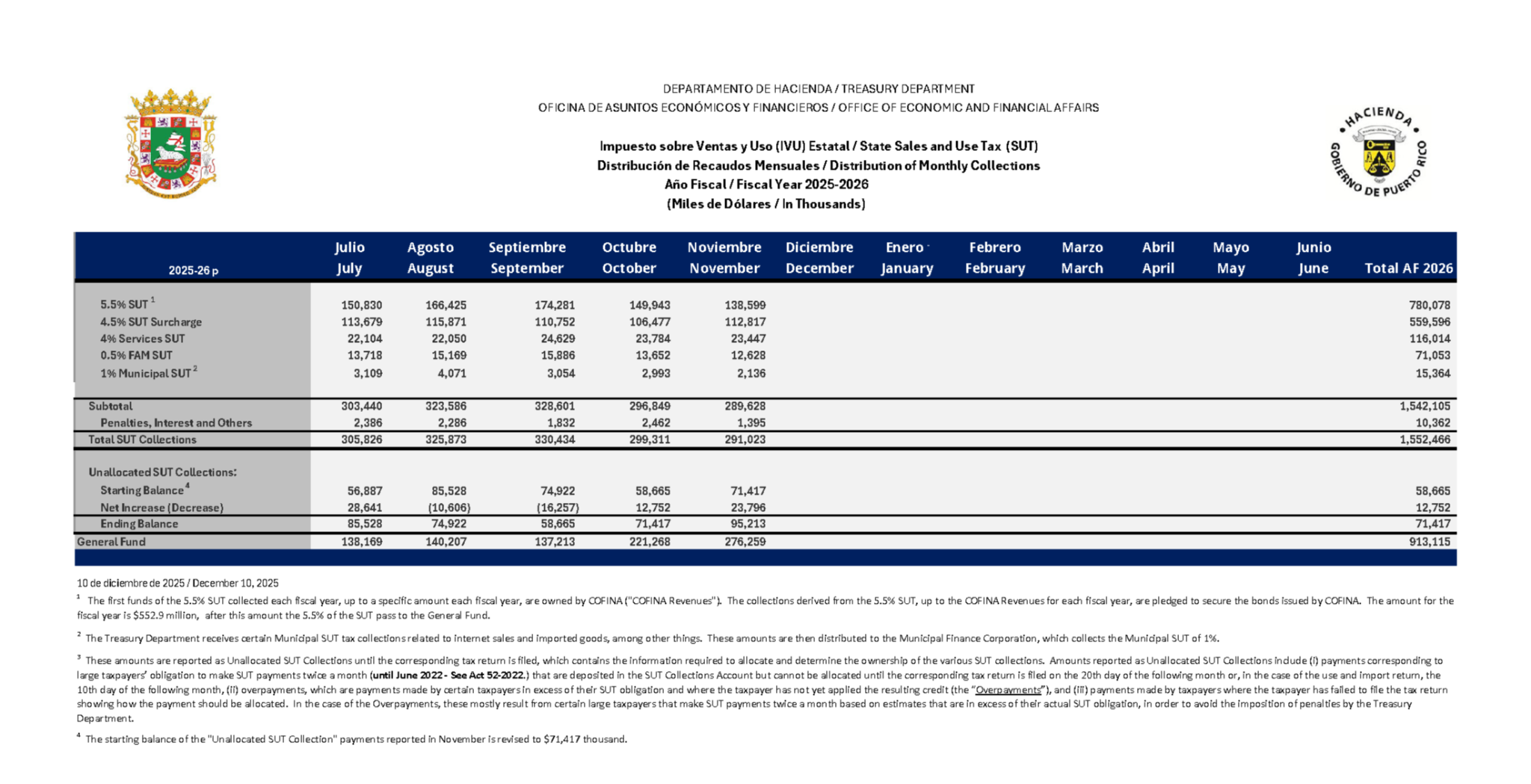

The Puerto Rico Sales Tax Financing Corporation (COFINA) announced today the publication of its audited financial statements for Fiscal Year 2025, together with a significant revenue milestone: as of October 21, 2025, COFINA has collected 100 percent of its projected statutory revenues for Fiscal Year 2026, totaling $552.9 million.

The audit, conducted by KPMG, resulted in an unmodified (clean) opinion with no findings or material adjustments, reaffirming COFINA’s strong internal controls and adherence to U.S. Generally Accepted Accounting Principles (GAAP). COFINA remains the first public corporation in Puerto Rico to complete its FY 2025 audited financial statements, continuing its record of timely and transparent reporting.

This is an important reflection of COFINA’s institutional strength and operational discipline. Reaching the FY 2026 revenue target in just over three months and maintaining a clean audit opinion demonstrate the Corporation’s continued fiscal soundness and commitment to investors and the people of Puerto Rico.

The revenue collections show that the Corporation’s pledged portion of the 5.5% Sales and Use Tax (SUT) continues to perform consistently above expectations.

COFINA’s audited financial statements and accompanying auditor’s letter are available for public access at www.cofina.pr.gov and will be posted on the Municipal Securities Rulemaking Board’s EMMA website.

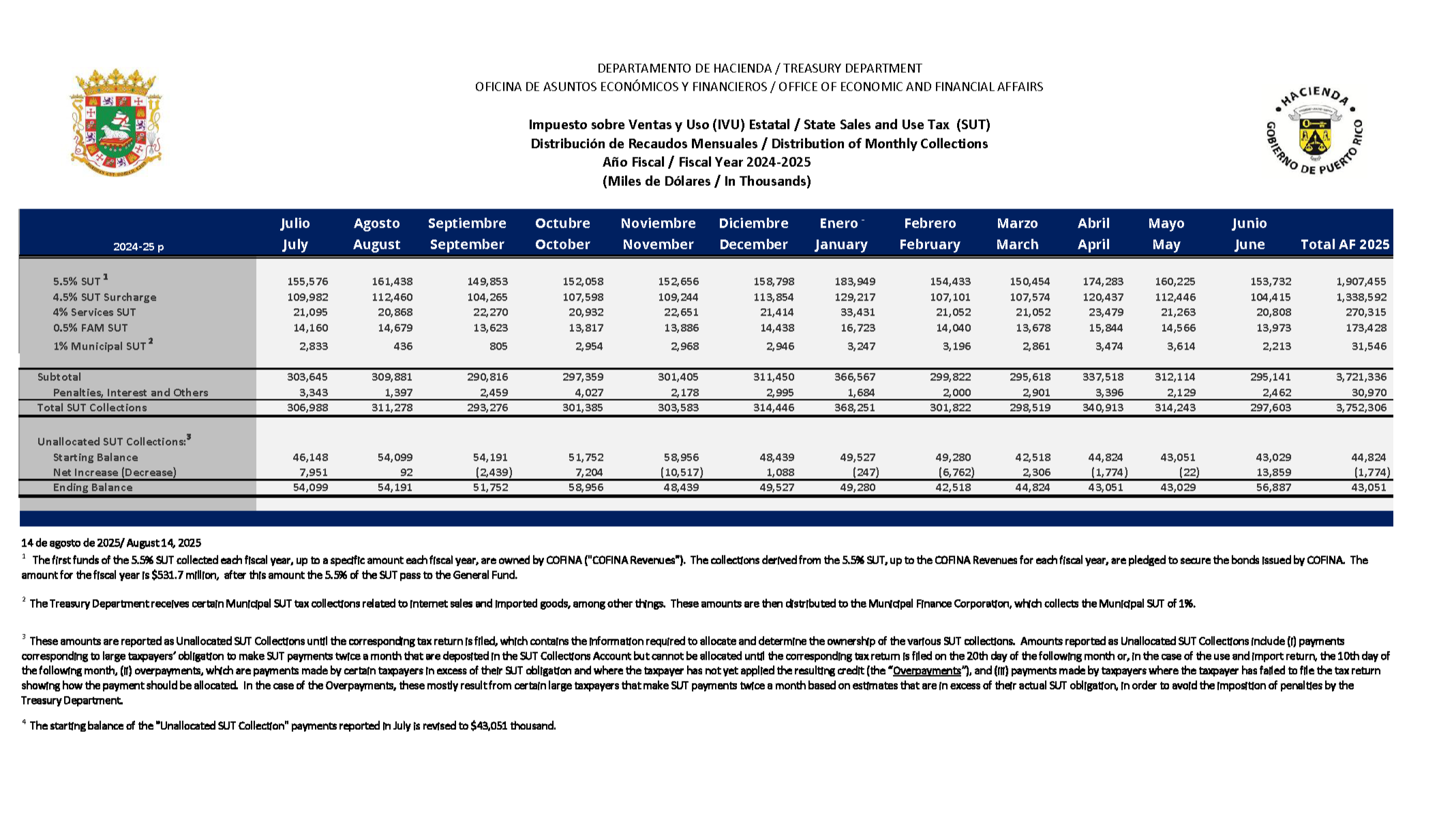

The Puerto Rico Sales Tax Financing Corporation (COFINA) is pleased to report that total 5.5% Sales and Use Tax (SUT) collections for Fiscal Year 2025 have exceeded projections. As of June 30, 2025, the Puerto Rico Treasury Department reports total 5.5% SU.T collections of $1.9 billion.

This performance translates to a Debt Service Coverage Ratio (DSCR) of 3.62x against COFINA’s contractual debt service, underscoring strong pledged revenue sufficiency and fiscal stability. The Corporation’s continued ability to collect pledged SUT revenues well in excess of debt service requirements supports its long-term creditworthiness and resilience.

COFINA remains committed to transparency, compliance, and proactive fiscal management in line with its certified Fiscal Plan and continuing disclosure obligations. We thank our partners at the Department of Treasury, the Trustee, and the broader public finance team for their coordination and commitment to COFINA’s mission

Puerto Rico Sales Tax Financing Corporation Releases 2024 Annual Report

San Juan, Puerto Rico – The Puerto Rico Sales Tax Financing Corporation (COFINA) proudly announces the publication of its 2024 Annual Financial Information and Operating Data Report. The report, which will be available on COFINA’s website and the Municipal Securities Rulemaking Board’s EMMA platform, provides an in-depth look at COFINA’s financial performance and operational highlights for the fiscal year ending June 30, 2024.

Key Highlights of the 2024 Annual Report:

- Financial Resilience: COFINA achieved a balance of $17.86 million by November 2024.

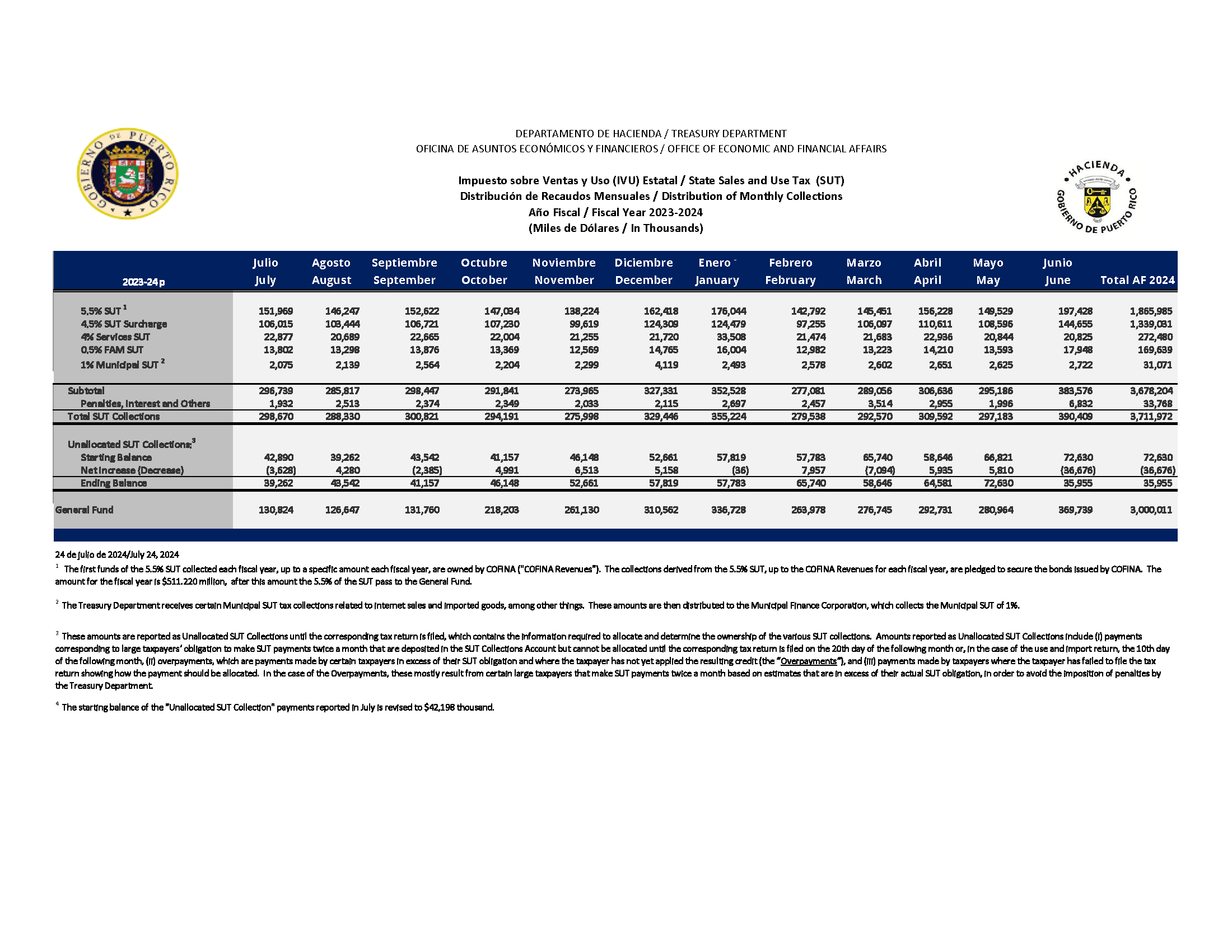

- Sales Tax Performance: Total Sales and Use Tax collections reached a record $3.66 billion, reflecting robust economic activity.

- Debt Obligations Met: COFINA successfully fulfilled its bond obligations, with $430 million allocated for interest payments and $74.2 million for principal payments in FY2024.

- Transparency Commitment: This report is part of COFINA’s continuing disclosure obligations under its 2019 Continuing Disclosure Agreement.

The report also highlights COFINA’s pivotal role in managing revenues derived from the Puerto Rico Sales and Use Tax, ensuring fiscal responsibility and the timely fulfillment of debt obligations.

COFINA remains committed to transparency and excellence in financial management as it continues to support Puerto Rico’s economic development.

For more information, please visit www.cofina.pr.gov.

Management Team

Board of Directors

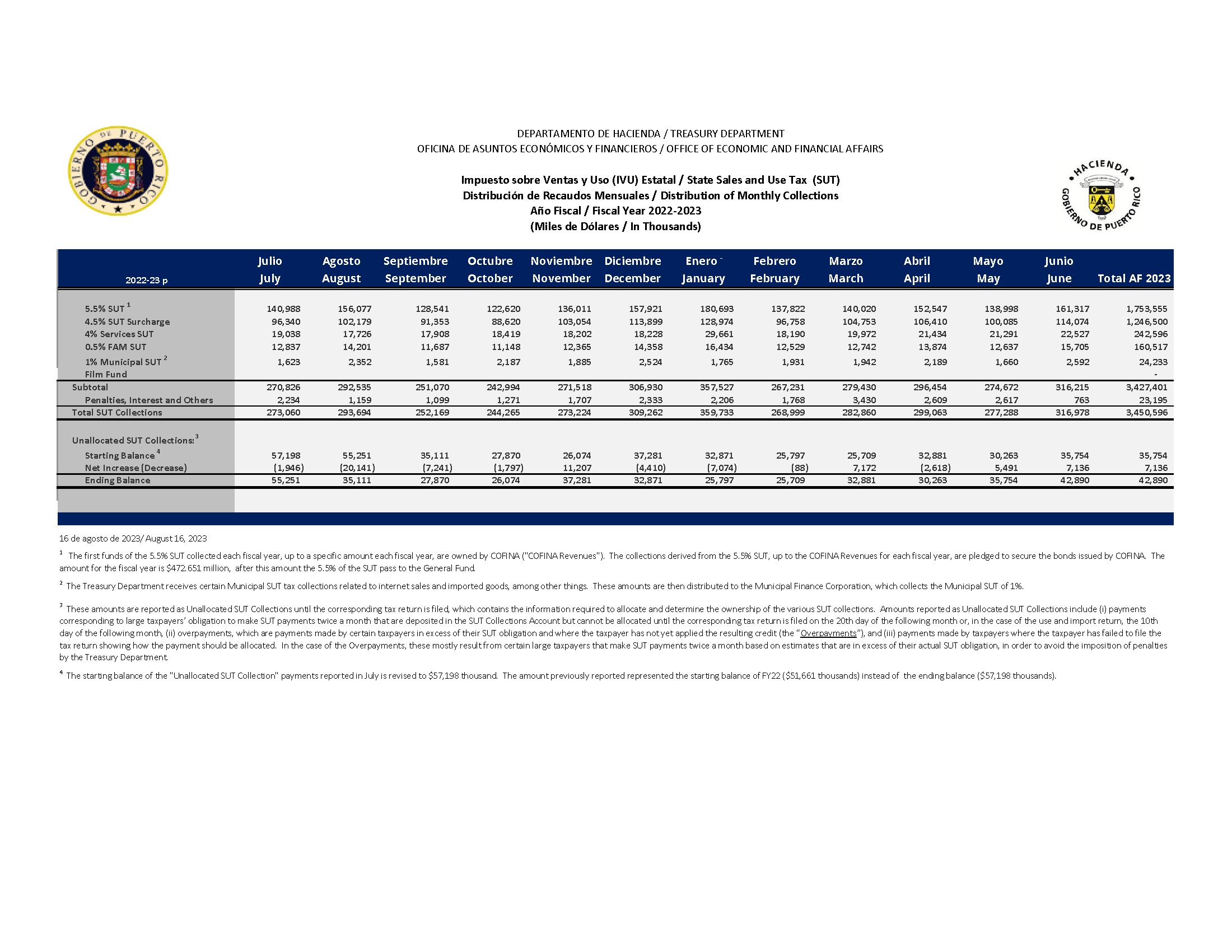

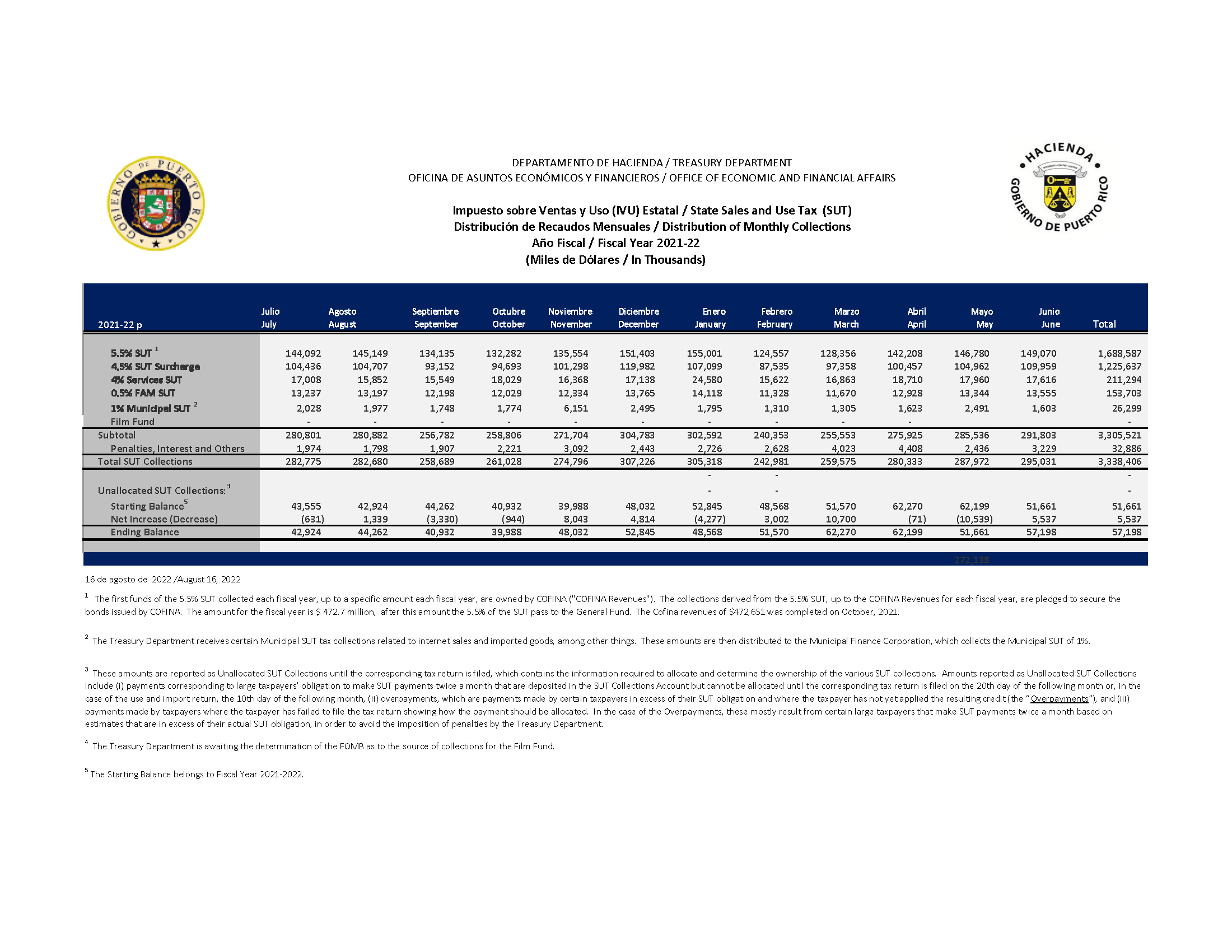

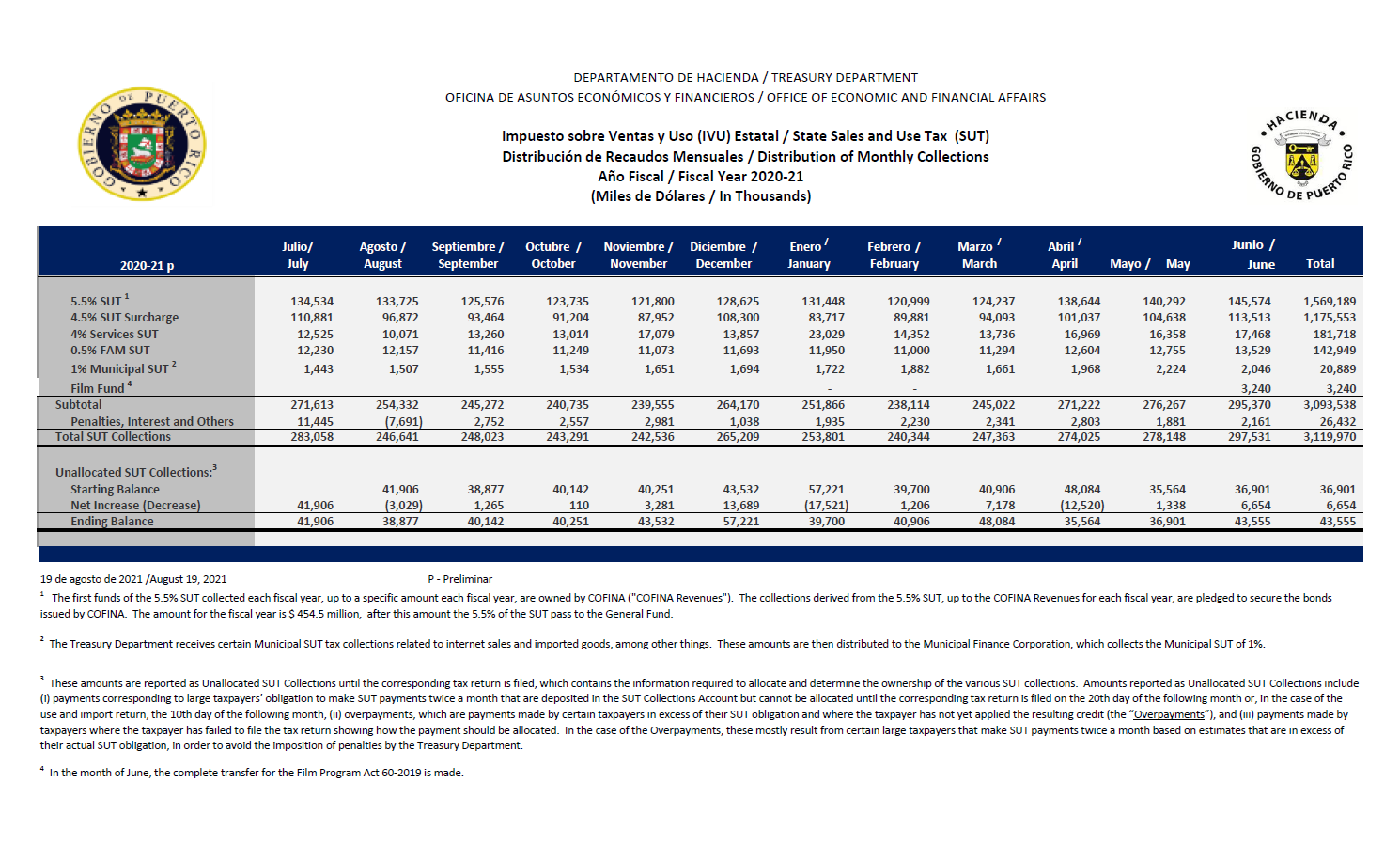

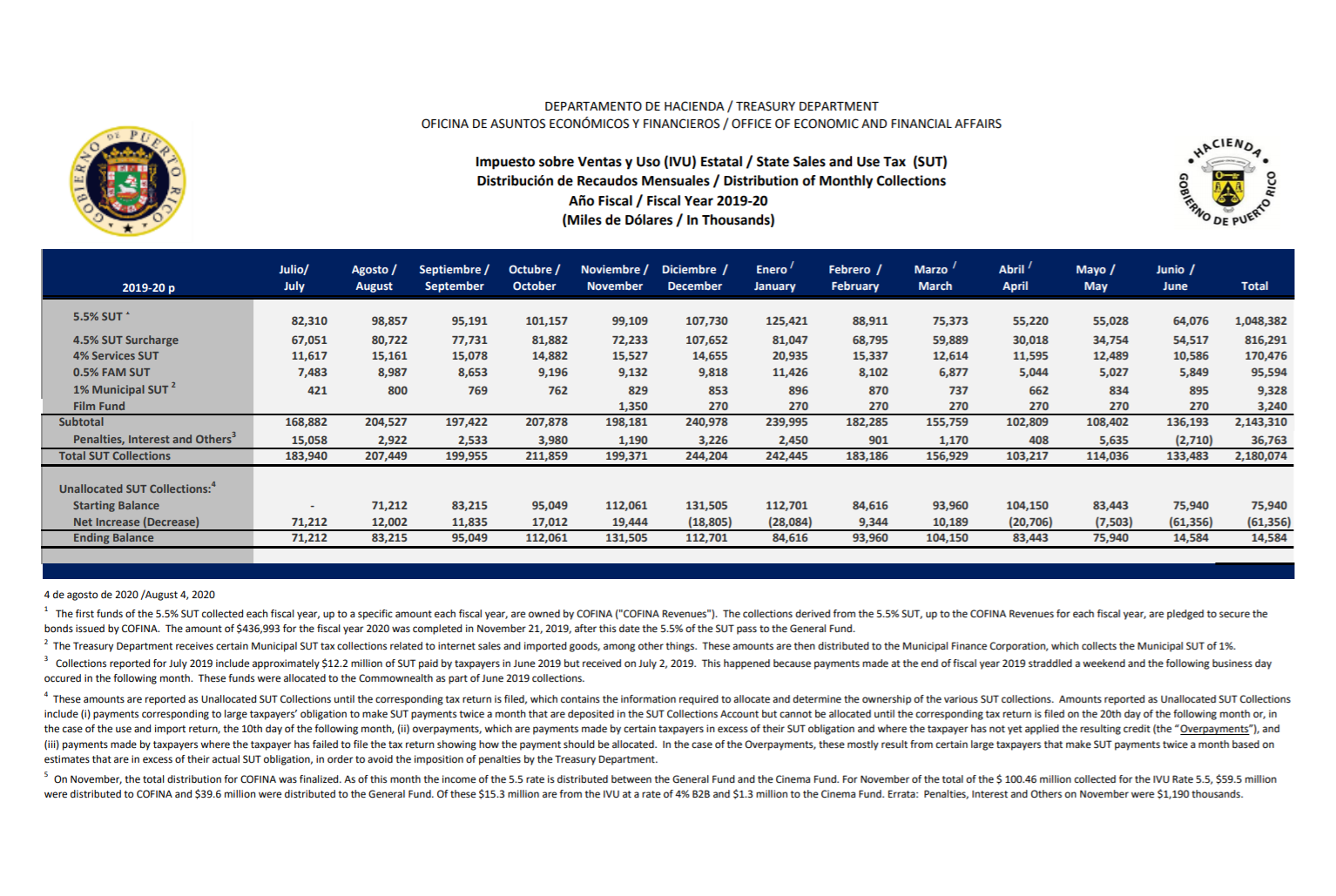

PR Department of Treasury SUT Collections Report

Fiscal Year 2026 - 5.5% COFINA SUT Collections

Talk to us

Have questions? Reach out to us directly.